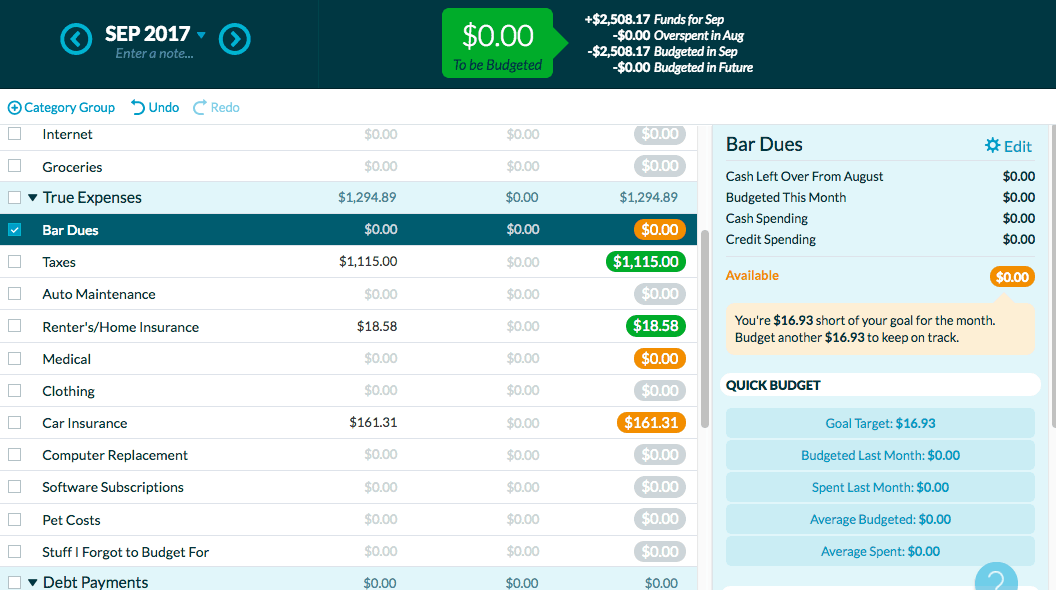

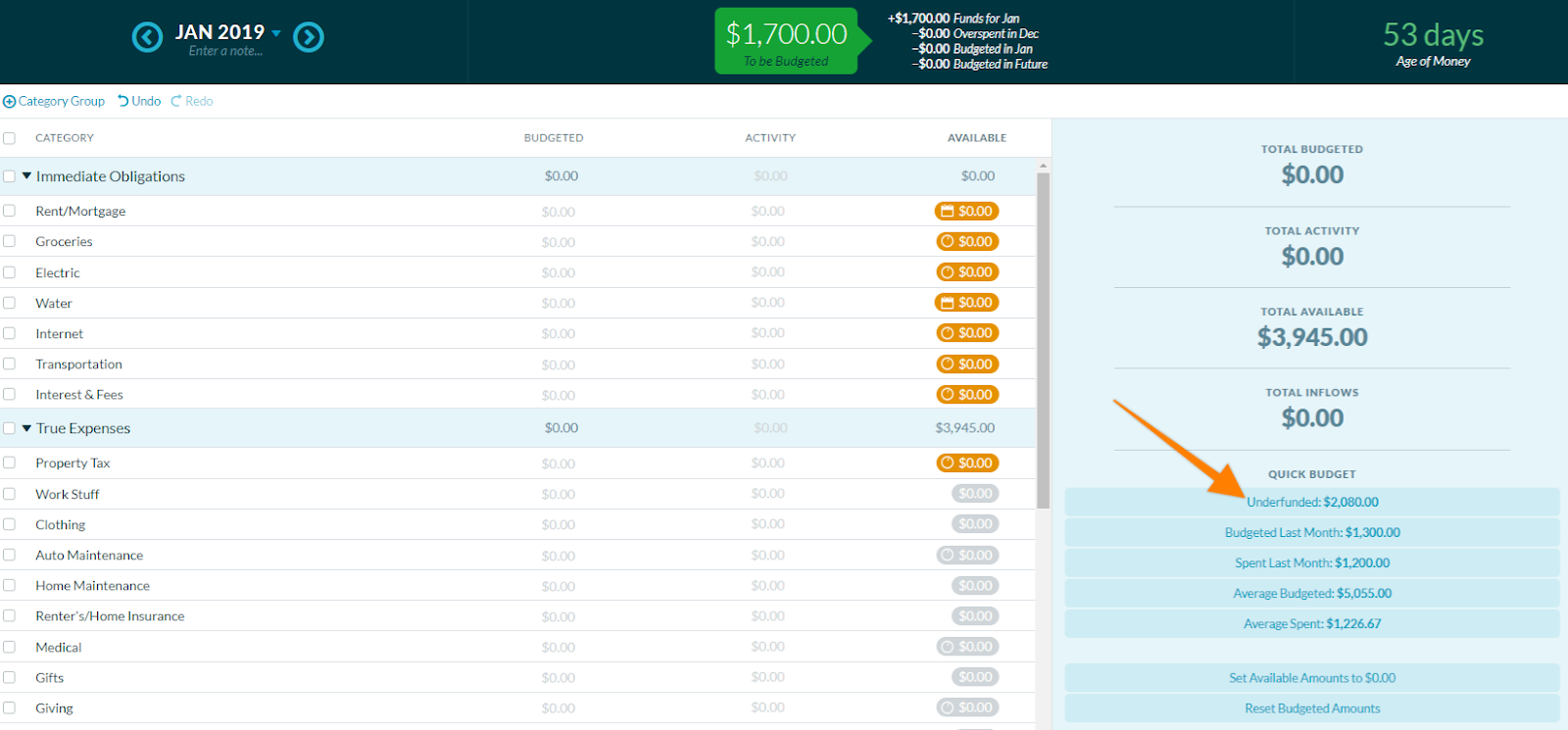

So the question of which budgeting tool is better depends on your unique situation. They’re both designed to show you how and where you spend your money, but it’s clear they offer slightly different services. Both Mint and YNAB provide a user-friendly tool to improve your money management skills-and financial future -by helping you budget effectively. The question of which service is better depends on your unique situation. Mint vs YNAB: Which app should you choose? Stop spending everything the minute it goes into your account, quit living a paycheck to paycheck lifestyle, and get to the point where you are spending what you earned last month. Be more purposeful about your spending, consistently spend less than you earn, and be more than prepared for the future. Stay on track with your long-term goals by anticipating and adjusting for overspending in specific categories in some months. Be flexible and allow yourself to move money around if you overspend in an area. Similar to a sinking fund, reduce your stress by taking those large, less-frequent expenses and break them into manageable, monthly bills. Every dollar you earn (and have in your budget) should be allocated to a specific purpose. YNAB’s budgeting strategy is built on four main rules that have been designed to help users live within their means, get out of debt, save money, and stop living paycheck-to-paycheck. This is similar to what’s known as a zero-based budgeting technique. YNAB steers users away from relying on traditional budgeting buckets and instead recommends building a budget based on individual income, giving every dollar a job in your budget. You also have the ability to track spending by specific categories and can look at your monthly cash flow to see an overview of where your money goes on a month-to-month basis.įinancial summaries and alerts via email or text messageĮmail or text alerts for unusual account activity, bill reminders, and low balancesĮasily customizable, digestible financial reportsĪutomatic categorization of downloaded transactionsĬan’t assign multiple savings goals to one accountĬompared to other budgeting apps on the market, You Need A Budget (YNAB) has a unique approach. You can sign up for alerts that will be sent directly to your email or smartphone regarding late fees, bill reminders, over-budget spending, rate changes, and more. Mint is an incredibly helpful tool because it keeps an eye on your finances, so you don’t have to. One of the most well-liked features among users is that the budgeting app automatically categorizes your transactions from linked credit and debit cards and will track them against a budget that’s customizable to your needs.

Ynab budgeting future update#

Every time you log-in, your financial data will update automatically, and you’ll be able to see your financial information in a sleek, user-friendly platform. In Mint, you’re able to build a personalized budget, track your spending, set any necessary reminders for bill payments, monitor your credit score, and see how your investments are performing. To get the most out of the Mint platform, you’ll need to link all of your accounts, including any checking or savings accounts, mortgages, credit cards, loans, investments, etc. This budgeting tool operates on the idea that to see where you stand financially, you need to see everything in one place. It’s owned by Intuit, the same company that makes Quickbooks and TurboTax. Keep reading to find out which of these budgeting apps is the best for you and your money.Īs one of the oldest and best-known budgeting apps (it has been around since 2006), Mint has a pretty solid reputation. This article will take a look at two of the most popular budgeting apps on the market You Need A Budget (YNAB), and Mint. If you’ve been considering incorporating a budgeting app into your financial plan, but aren’t quite sure where to start, we’ve taken the first step for you. It’s helpful to know which ones are designed with your needs in mind while still offering exclusive features. However, there are dozens of options to choose from, with each one having something unique to offer. If you’re looking to rein in your monthly spending and get your finances under control, using a budgeting app may be worth your consideration. While budgets tend to be associated with restrictions and unnecessary hassles, there are numerous tools that can help ease the process. Yet so many people are reluctant, and often nervous, to incorporate this step in their financial plan. Creating a budget (and sticking to it) is one of the most important things you can do to ensure you’re managing your money correctly.

0 kommentar(er)

0 kommentar(er)